Trading operations

Increase earnings

ESG performance directly contributes to sustainable profits. The progress we have made under the Vitol Energy Transition Initiative (VETI) directly translates to increased earnings. For example, making ESG core to the voluntary carbon projects we are developing means that over 75 mt CO2e of high quality credits is forecast to be generated by 2030, helping counterparties to meet their energy transition and Net Zero aspirations.

Manage operational risks

Understanding and managing ESG risk across transactions helps us to carefully manage operational risks. During 2022, we undertook risk based ESG due diligence on all companies in which we took equity and increased the breadth of our ESG KYC (Know Your Counterparty) activities.

Address legal & regulatory matters

Positive ESG performance helps to reduce Vitol’s risk of adverse legal action. Shortcomings generally lead to downside risk. We continue to keep abreast of, and comply with ESG regulations across our activities.

Sustain talent & productivity

A strong ESG proposition helps to retain and attract talent. Our ESG report received positive feedback from stakeholders, particularly employees and new joiners, who appreciate transparency around our role as an energy trader and how we embed ESG across our business.

Investment portfolio

Optimise resource use & cost efficiency

Optimising resources is better for the environment and makes economic sense. We continue to review resource consumption and encourage improved efficiency across our portfolio.

Meet the highest ESG standards

Strong ESG performance is an enabler and reduces the risk of adverse business impacts. Undertaking more than 15 audits, reviews and integration visits, monitoring, analysing, and reporting lagging and leading ESG KPIs has facilitated an improved performance and acts as a precursor to negative events.

Rebalance capital allocation

Allocation of capital to transitional and sustainable business opportunities e.g. renewables, environmental products trading and LNG enhances the sustainability of Vitol’s business. Our portfolio now comprises $3.3 bn of transitional and sustainable non-current assets.

ESG performance monitoring

We have over 40 ESG KPIs aligned with relevant industry-accepted definitions. Monitoring KPIs enables us to understand performance, take appropriate action and is one element underpinning our audit programme.

ESG audit programme

We run a risk-based on the ground ESG audit programme. Each year portfolio companies are appraised against the ESG framework and a bespoke audit protocol.

ESG due diligence

We undertake ESG due diligence in close collaboration with our investments and origination teams on all potential acquisitions, and uses external consultants as necessary.

Incident management

Vitol has an incident management process covering major incidents. It also includes links to function-specific response plans for areas such as IT security and cyber risk, or physical assets, e.g. shipping or upstream.

Training

The Vitol ESG and operations departments continue to develop tailored training to relevant internal stakeholders.

ESG network

The Vitol ESG network was established in 2020 as a support mechanism for managers from the portfolio companies. They can seek advice from peers, raise concerns and share results from incident investigations.

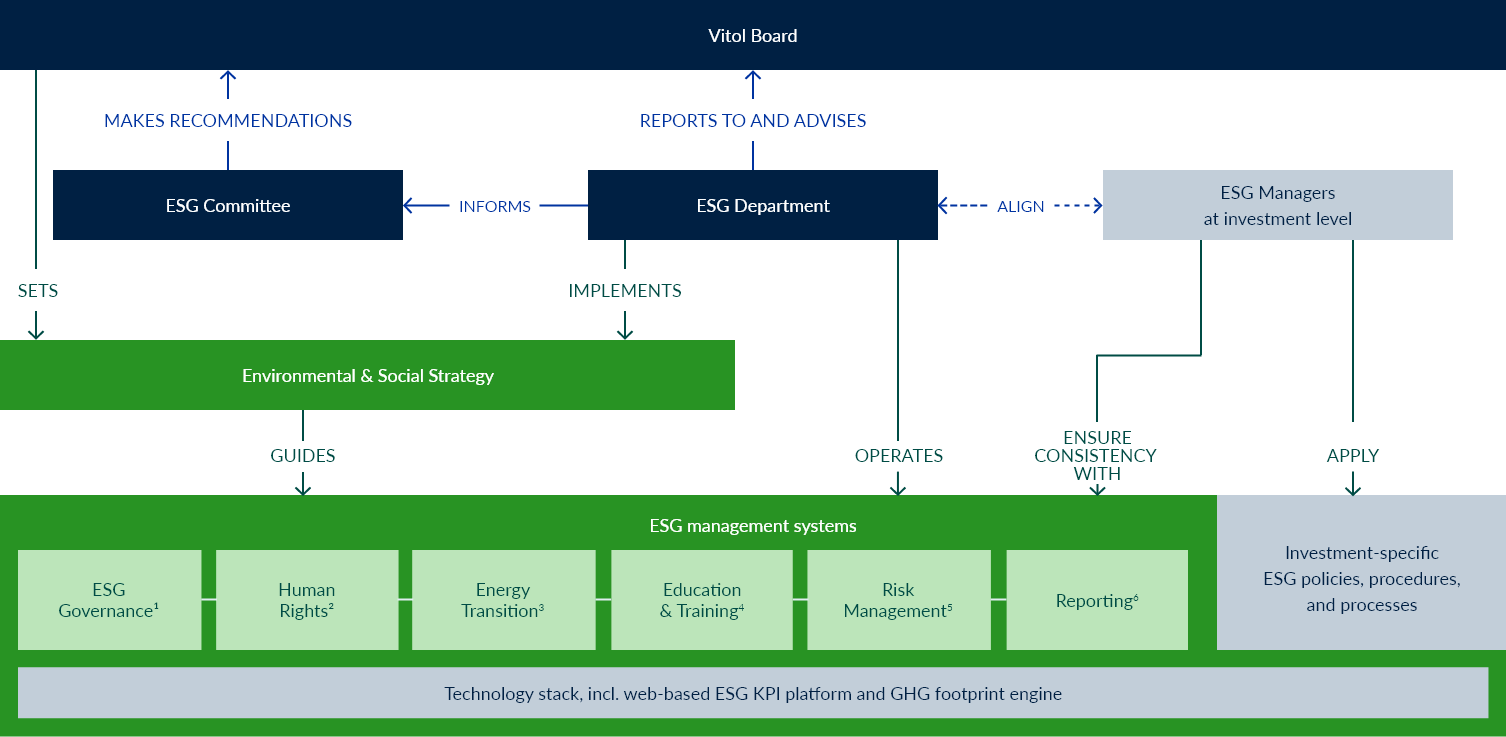

- ESG governance includes the ESG Framework, ESG guidance, procedures, and standards, KPI development & monitoring, annual audit plan, incident management, ESG due diligence

- Human rights includes UNGP implementation, human rights regulations, salient issues, reporting & DD requirements

- Energy transition includes VETI objectives & workstreams, GHG objectives & performance, TCFD implementation

- Education & training includes director training, bespoke training, ESG network for investments

- Risk management includes ESG risk register & assessment matrix, ad hoc reviews

- Reporting includes coordination & structure, KPI input, ESG rating, stakeholder engagement

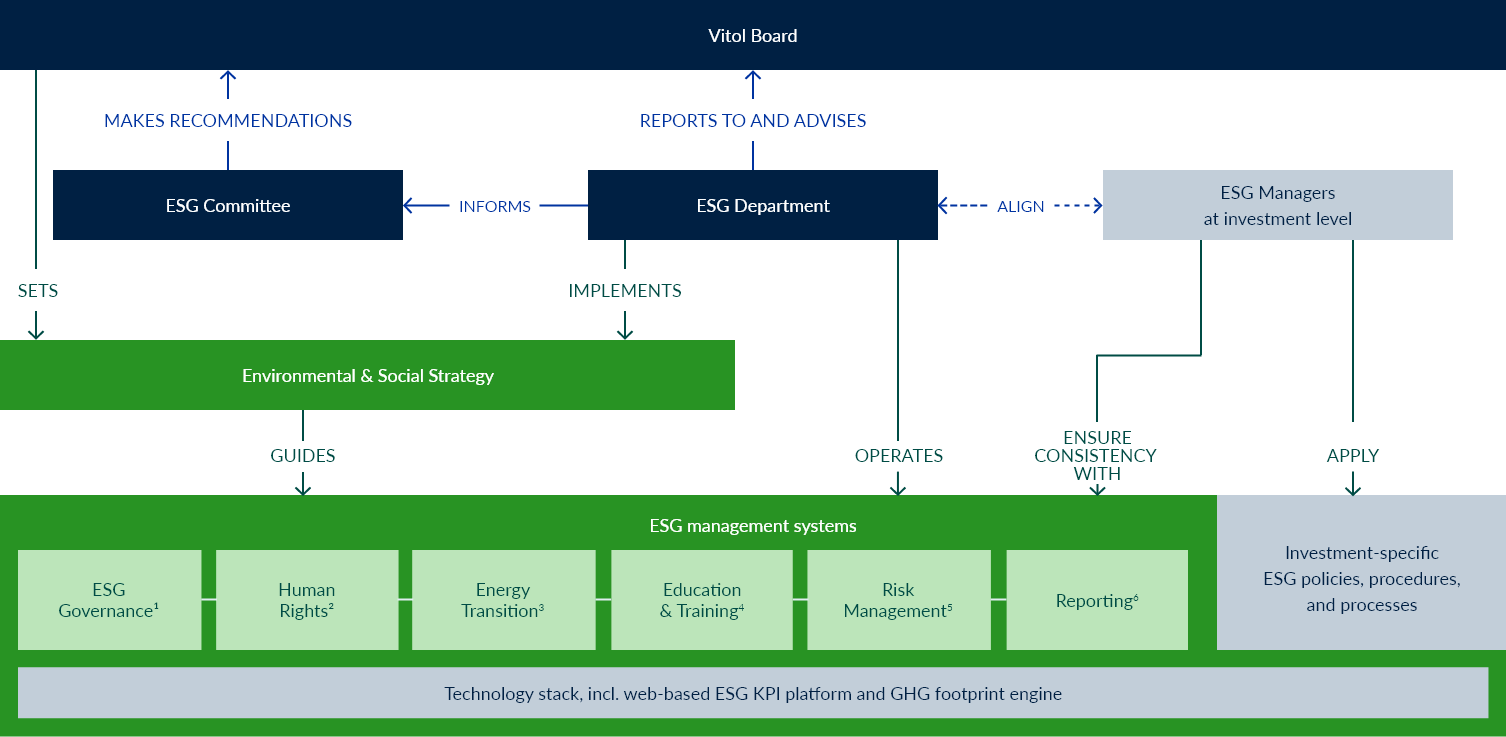

- ESG governance includes the ESG Framework, ESG guidance, procedures, and standards, KPI development & monitoring, annual audit plan, incident management, ESG due diligence

- Human rights includes UNGP implementation, human rights regulations, salient issues, reporting & DD requirements

- Energy transition includes VETI objectives & workstreams, GHG objectives & performance, TCFD implementation

- Education & training includes director training, bespoke training, ESG network for investments

- Risk management includes ESG risk register & assessment matrix, ad hoc reviews

- Reporting includes coordination & structure, KPI input, ESG rating, stakeholder engagement

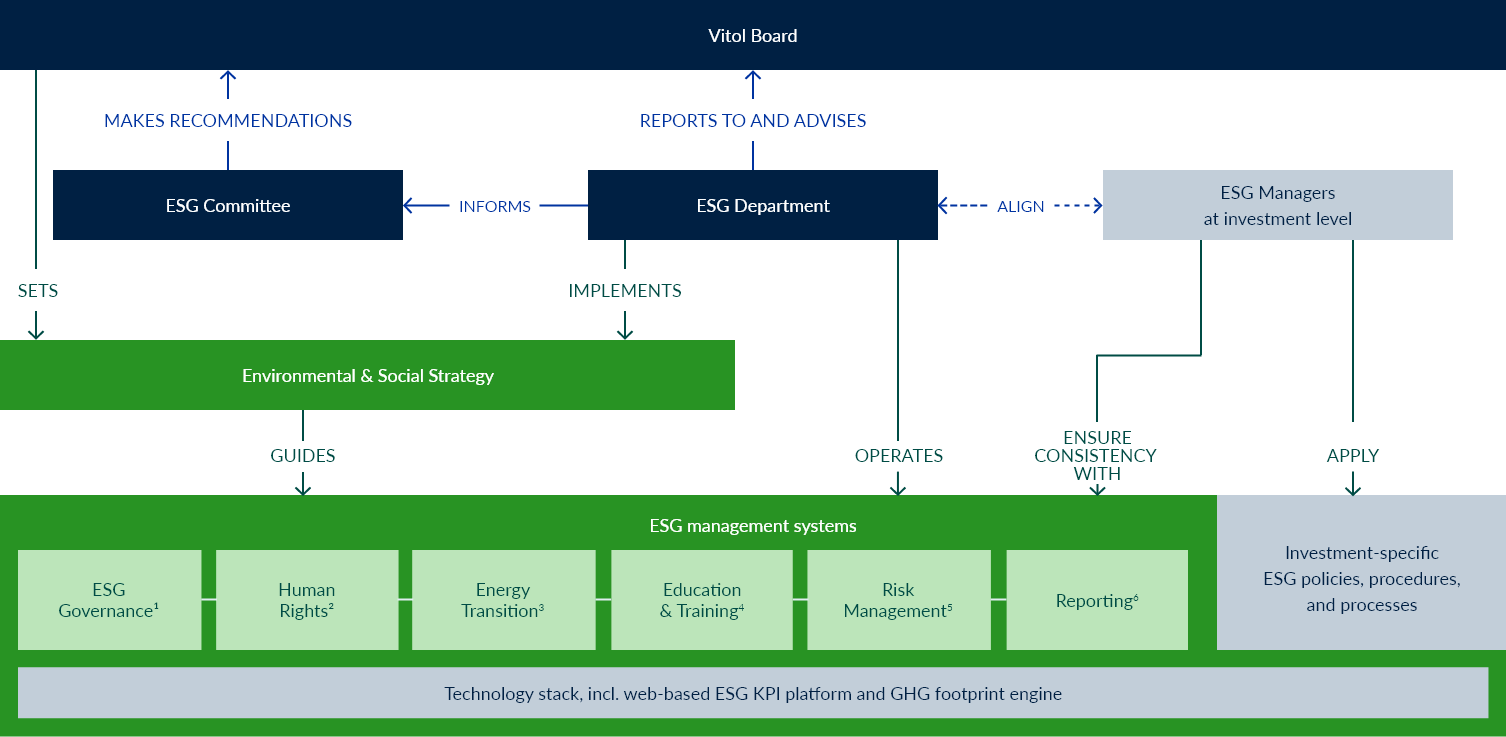

- ESG governance includes the ESG Framework, ESG guidance, procedures, and standards, KPI development & monitoring, annual audit plan, incident management, ESG due diligence

- Human rights includes UNGP implementation, human rights regulations, salient issues, reporting & DD requirements

- Energy transition includes VETI objectives & workstreams, GHG objectives & performance, TCFD implementation

- Education & training includes director training, bespoke training, ESG network for investments

- Risk management includes ESG risk register & assessment matrix, ad hoc reviews

- Reporting includes coordination & structure, KPI input, ESG rating, stakeholder engagement