Aviation, like maritime and road transportation, shares a common goal of reaching net zero by 2050. However, a combination of immature and expensive technological solutions, coupled with a greater warming impact, means the sector presents a unique decarbonising challenge.

Despite representing a relatively small portion of global emissions, it is the fastest-growing mode of transportation, surpassing road, rail, and shipping. Vitol forecasts jet fuel demand to reach around 7.5m b/d by 2025, 8.2m b/d by 2030 and just over 9m b/d by 2035.

2% Aviation's contribution to global energy-related CO2 emissions

70% Mandated proportion of SAF in aviation fuel by 2050

0.1% Contribution of SAF to current jet demand

While currently responsible for approximately 2% of global energy-related CO2 emissions, this percentage is expected to rise, as other sectors undergo decarbonisation efforts. According to the United Nations’ International Civil Aviation Organization (ICAO), aviation emissions will nearly triple by 2050. By that time, aircraft could potentially account for a quarter of the global carbon budget,

There is also a growing understanding of the non-CO2 impact of aviation on climate change. Due to emitting other gases such as oxides of nitrogen, soot particles and water vapour at high altitudes, the warming impact of aviation is stronger.

So, what are the options for aviation? Improved efficiency in airplane design and engine development have almost reached the limit of what is reasonably possible. New aircraft can be up to 20% more efficient than the models they replace, but this efficiency gain is outweighed by the growth in activity. According to the IEA, fuel efficiency improved by just 1.9% between 2010 and 2019, compared with 2.4% between 2000 and 2009. Which leaves the sector relying on a narrow combination of solutions, of which very few currently work in practice.

What solutions?

The most viable long-term decarbonisation pathway is sustainable aviation fuel (SAF). SAF is a biofuel derived from waste such as plants, cooking oil or non-food crops. Even though burning these fuels produces CO2 emissions, the lifecycle emissions are reduced by up to 80%, compared to traditional kerosene. And as a drop-in fuel it is also fully compatible with existing aircraft and fuelling infrastructure.

The problem is there simply isn’t enough feedstock in the world to scale up SAF to the volumes needed to bring down the price or encourage a concerted switch to the sustainable fuel. And costs are likely to increase as readily available feedstocks are exhausted. In 2022, production of SAF tripled to 300 million litres, but that’s just 0.1% of jet fuel used by commercial airlines.

As a result, it remains prohibitively expensive. Currently SAF is more than six times as expensive as conventional jet fuel.

One option is synthetic SAF. This is produced by combining captured carbon with green hydrogen made from water and renewable power. The technology, however, is less developed than that for bio-SAF, so current production costs are higher. For example, synthetic SAF will require substantial improvements in large-scale electrolysers that produce zero-carbon green hydrogen by using renewable electricity to split water into oxygen and hydrogen. More efficient technologies will also be needed for capturing the significant volumes needed of CO2. This could be achieved via carbon capture storage and utilisation (CCUS) or direct air capture (DAC), both of which are at the nascent stage.

If different sectors collaborated to drive down the cost of this technology, then there is optimism that close to 2050 synthetic SAF could be produced in bigger volumes than bio-SAF.

Is there an alternative?

Alternative propulsion technologies, such as battery-electric and hydrogen could play a role in the sector over short distances, however, there is little expectation that these can be developed for long-haul journeys, or be developed in time to meet 2050 targets. The World Economic Forum suggests development and deployment at scale could take 10 to 20 years (Airbus announced its ambition to develop a zero-emission commercial aircraft by 2035, using hydrogen propulsion).

It also would require huge amounts of clean energy. Shifting aviation to carbon-free fuels may require up to 1,700 terawatt hours (TWh) of clean energy by 2050, according to a recent whitepaper from the World Economic Forum and McKinsey. This would require the equivalent of a solar farm half the size of Belgium.

Moreover, the cost of such a shift would be between $700 billion and $1.7 trillion by 2050, the report stated, to develop the off-airport infrastructure, power generation and hydrogen electrolysis and liquefaction.

What else can the industry do?

Reducing the emissions intensity of the aviation sector will be critical if long-term targets are to be met. Aside from SAF, a key pathway will be offsets, which allow people to compensate for emissions by buying carbon credits generated by projects that reduce GHG (plants that absorb CO2 for example) or avoid adding to it (such as preventing deforestation). In this way CO2 emitted by a flight is cancelled by the GHG absorbed by the offset project. Doubts remain around transparency, quality and transparency around these projects, hindering uptake.

The carbon offsetting and reduction scheme for international aviation (CORSIA) is a global initiative that will play a critical part in aviation’s path to net zero. Developed by the International Civil Aviation Organisation, it is designed to help the sector in the short – and medium-term by complementing emissions reduction initiatives within the sector. To meet medium and long-term aviation goals carbon markets are essential. In the absence of mandated fuel blends the emphasis will remain on offsets.

From January 2024, 126 countries are participating in CORSIA’s voluntary phase, which runs until 2026. Also, any airline that participated in the 2021-2023 CORSIA period will start reporting their offsetting requirements for that period, which will provide a clearer picture of the level of offsetting requirements airlines are going to face.

Collaboration and regulation

There is a clear belief in SAF as a viable pathway to help the aviation sector achieve net zero by 2050. But the industry should focus on scaling production and lowering cost. Collaboration rather than a patchwork set of agreements will be more effective if the sector has any chance of meeting its decarbonising commitments.

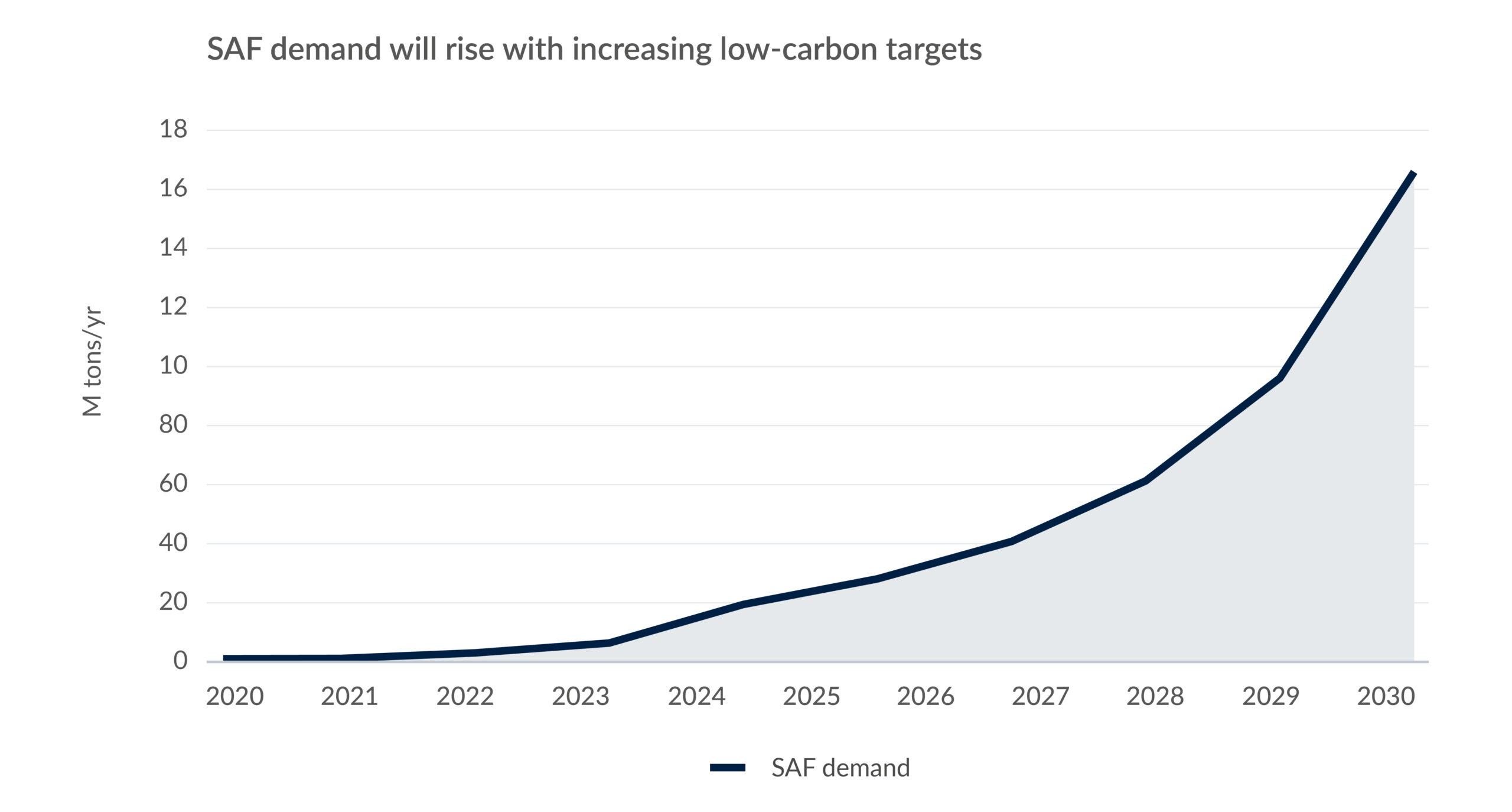

This can already be seen in the EU’s RefuelEU aviation initiative – which was launched on Oct. 9 and is part of the EU’s Fit for 55 package – which mandates that aviation fuel suppliers increase the amount of sustainable aviation fuel (SAF) they deliver to 70% by 2050, and that airports have suitable infrastructure for alternative fuels. More specifically, fuel suppliers will have to incorporate 2% SAF in 2025, 6% in 2030, 20% by 2035, rising to 70% by 2050.

Earlier this year, Airbus and the China National Aviation Fuel Group (CNAF) signed an MoU to intensify cooperation on the production, competitive application and common standards formulation for SAF. This followed an earlier memorandum of cooperation signed between China’s State Power Investment Corporation Ltd and Cathay Pacific, which covered four SAF production facilities.

While in September 2022, the US announced the Sustainable Aviation Fuel Grand Challenge, which offers funding to demonstrate new fuel and aircraft technologies.

Such examples of collaboration are encouraging for the industry, but the sector will need a clear long-term strategy with which governments, businesses and wider society are aligned to affect a more sustainable aviation industry.