Over the last few years, the use of biofuels has evolved to become an integral element of the marine bunker market. This growth has been led primarily by the container and car carrier industries, as customers demand lower carbon intensity delivery of their goods. Using the industry’s ‘book and claim’ system, biofuels could be sourced at major bunkering hubs at the liners’ convenience, with reduced emissions allocated to customers’ deliveries throughout the supply chain.

However, things are changing; the introduction of the FuelEU Maritime at the beginning of the year which mandates that vessels consume lower greenhouse gas intensity (GHGi) fuels, or face expensive penalties means that uptake of biofuels into the marine industry is likely to increase significantly.

Which biofuels for maritime?

Biofuels are renewable energy sources derived from organic matter, including plants, algae, and animal waste.

Classified into different types based on their source, understanding the full life cycle emissions of a biofuel (the so called well-to-wake metrics) is key in identifying the most sustainable options for shipping. It is therefore waste-based biofuels that are of particular interest to the marine industry as the FuelEU Maritime does not recognise crop-based feedstocks.

Waste-based biofuels

Methyl Esters (e.g. FAME)

Transesterification of vegetable oils and animal fats form a biodiesel called FAME (fatty acid methyl esters); the most commonly used feedstock for marine is waste-based FAME from Used Cooking Oil (UCO) esterified into used cooking oil methyl ester (UCOME). This can be directly run in a marine engine.

Other waste-based FAME feedstocks include palm oil milled effluent (POME), a residue stream from the palm oil industry which is also esterified to create POMEME.

Hydrotreated vegetable oil (HVO)

HVO is derived from UCO or similar products that have gone through a hydrotreating process. It is a direct diesel replacement and has a higher calorific value, better cold properties and lower levels of particulates than UCOME. However, the additional processing means it has a higher GHGi than UCOME and is in high demand in the road sector where is it also used as a direct diesel replacement.

Non-food biofuels

Biofuels that are derived from non-food biomass are considered to be more sustainable. As a result, their use is incentivised in some jurisdictions to encourage uptake from these sources. They can include cellulosic or algal sources or nut shells – with cashew nut shell liquid (CNSL) being actively trialled in the marine environment.

Synthesised biofuel

Bio-methanol is not a FAME-based product blended with methanol. It is instead methanol synthesised from biogas rather than natural gas and is chemically identical to fossil methanol.

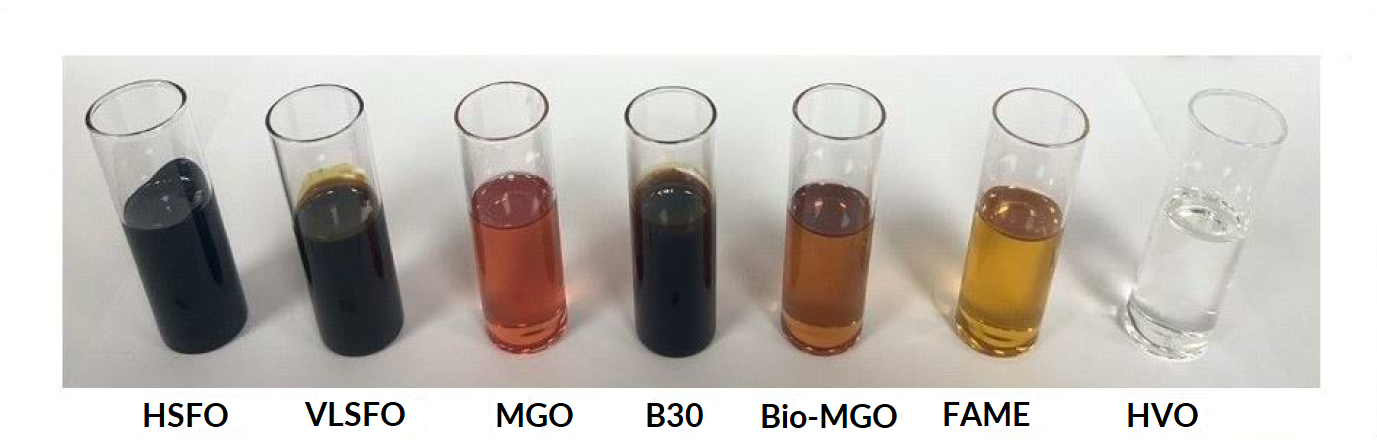

Physical appearance of the different fuels

Photo credit: CIMAC

The impact of regulation on the marine biofuels market

FAME-based biofuels can be blended with conventional fuels in order to lower the GHGi intensity of the fuel mix. The concentrations of biofuel are subject to a number of constraints, but in 2022 the International Maritime Organisation (IMO) settled on a unified interpretation; that blends with concentrations of up to 30% biofuels, commonly known as B30, would not be subject to additional nitrous oxide (NOx) testing. This unified interpretation was a significant milestone for biofuels in the marine industry as it removed the need for operators to seek exemptions from flag states to use B30 fuels in ship engines.

Limits on biofuel use remain – IMO regulation from the Marine Pollution Convention (MARPOL) states that no more than 25% FAME can go into a bunker vessel cargo tank unless it is an IMO Type II tanker – rare amongst the world’s bunkering fleet. This regulation means that in reality B24 is the highest concentration that can be delivered on board for most jurisdictions.

The exception to this is the port of Singapore which has recently implemented the draft interim guidance on the carriage of blends and biofuels and MARPOL Annex I cargoes by conventional bunker ships which means that as of 7 March conventional bunker ships can carry biofuel blends of up to B30 without seeking the Marine Port Authority’s (MPA) separate approval.

This limitation is due to be addressed more widely at the upcoming Marine Environment Protection Committee (MEPC)-83 – an IMO meeting in April 2025 – where it will be confirmed whether B30 will be allowed in the bunker vessel cargo tanks thereby providing consistency across the two regulations.

However, in order to supply higher concentrations of biofuels – up to B100 – specialist bunker vessels, such as the Marine Future are required.

As a final twist, the inland waterway status of the ARA (Antwerp, Rotterdam, Amsterdam) region means the MARPOL regulation is not applicable. Higher concentrations of biofuel blends can therefore be delivered on board, favouring Rotterdam as a biofuel bunkering hub. The Dutch mandate to increase the use of advanced biofuels also incentivises industry through the form of a tradeable certificate awarded to marine or other transportation industries, known as the Hernieuwbare Brandstof Eenheden (HBE) or Renewable Fuel Unit. This dual regulatory support has further cemented Rotterdam as a bio-bunkering hub.

Marine Future - IMO Type II bunker barge

The growth of Singapore in marine biofuels

In October 2024, Singapore took over from Rotterdam as the world’s premier biofuel bunkering port. A combination of EU Anti-Dumping Duties (ADD) and a change of export rules in China meant UCO became competitive in Singapore. This also coincides with an increase in demand driven by the new Fuel EU Maritime legislation, and with stricter requirements for owners to reduce their IMO regulated carbon intensity indicator (CII).

| Bunker sales breakdown ('000 tonnes) | 2024 sales | YoY change (%) |

| Total sales | 54,923.59 | 5.98 |

| Conventional fuel | 53,575.19 | 4.66 |

| Biofuels | 884.46 | 68.75 |

| LNG | 463.95 | 318.54 |

Singapore continues to excel as a maritime decarbonisation hub with the Maritime and Port Authority (MPA) pushing through a number of innovative initiatives, including mass-flow-meters (MFM) and electronic bunker delivery notes (E-BDNs)

How can biofuels help me comply with my regulatory obligations?

Waste-based biofuels certified through initiatives such as the International Sustainability & Carbon Certification (ISCC-EU) are required to comply with the FuelEU Maritime regulation. These fuels need to be consumed on a leg to, from, or within the EU; they cannot be mass balanced across a fleet like the voluntary book and claim system. This nuance will increase the demand for biofuels in more locations, and because the FuelEU Maritime regulation is designed with such a steep and increasing penalty, it will also encourage uptake.

Certified biofuels can also reduce the EU Emissions Trading Scheme (EU-ETS) obligations of a vessel, another EU mandated tax on the emissions of the vessel out of the stack. EU allowances are calculated on each tonne of fuel consumed and have to be purchased and surrendered to the ETS. Biofuels can reduce this tax to zero, in addition to supporting compliance with the FuelEU Maritime requirements.

The IMO’s interim regulation for decarbonisation is currently the CII (Carbon Intensity Indicator), where vessels are rated A-E depending on their efficiency of trade. Whilst this regulation is to be reviewed in 2026, certified biofuels that ensure a 65% GHGi reduction compared to the fossil fuel alternative will count as ‘zero emissions’ and thus, can move a ship from a poor D or E rating to a compliant rating of C or better.

Biofuels as the decarbonisation solution for now

The maritime industry faces increasing pressure to reduce its carbon footprint and transition to more sustainable fuels, and the IMO has set targets for their mid-term measures with an implementation pathway that is currently being debated. These measures are aggressive; aiming for a target of net-zero by 2050.

Whilst a number of options present themselves to new tonnage under construction, such as dual-fuel engine technologies and more efficient hull shapes, the existing fleet has to utilise the options available today. Biofuels are a drop-in fuel, and a direct replacement for fossil fuel alternatives. In its first year, the FuelEU Maritime’s 2% GHGi reduction mandate can be reached with 3% of a vessel’s fuel mix being B100 or about 10% being B30, or by the use of flexibility measures that allow the transfer of overcompliance from one vessel to another in a pool. In addition, overcompliance with the regulation can be banked for future years, increasing the value of using marine biofuels now for conventionally-fuelled vessels.

As FuelEU Maritime steps up to 6% GHGi reduction in 2030, and the IMO mid-term measures come in force, the demand for biofuels is expected to increase within marine. In addition, the sector is likely to be competing for biofuel volumes with other sectors such as road and aviation. The IMO has yet to define its stance on crop-based versus waste-based biofuel feedstock, and is due to provide clear guidelines about the impact of indirect land use change (ILUC) on biofuel lifecycle emissions.

Marine is adaptable, and as demand increases, other niche biofuels are expected to become more marketable and acceptable, such as brown grease, fatty acid bottoms, TPO (tyre pyrolysis oil), and cover crops.

Ultimately, we see the use of biofuels as a key element in the decarbonisation of shipping, until such a time as the industry transitions to other fuel sources such as LNG, bio-LNG, and eventually e-fuels.